Over the past few years there have been significant changes to land tax regimes across Australia. These include the imposition of penalty rates for foreign owners of Australian real estate, trustee surcharge regimes for land held on trust, and the tightening of aggregation models. In some cases the changes were implemented a few years back and arrear payments may arise. Simply put, a land tax surcharge may apply if you are a foreign person/resident and you own property in Australia. If you are a non-resident of Australia and own property in Australia we recommend you contact the relevant authority to register.

SUMMARY

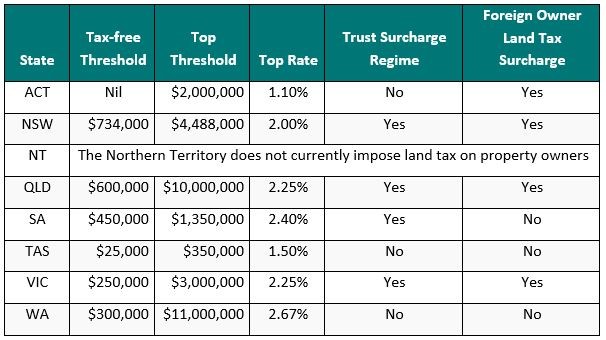

Below is a generic summary of the laws applicable to the various states. The material has been made available for informational and discussion purposes only. It is not professional advice. From 1 July 2020, the land tax headlines across the country can be summarised as follows:

These high-level figures, while useful, do not paint a full picture of land tax across all states and territories.

For example, while the ACT recently removed land tax on commercial properties, it was replaced with a very severe “variable charge”. While the top land tax rate of 1.1% looks attractive at first glance, the variable charge on commercial land in the ACT can be in excess of 5%.

South Australia, Tasmania and Western Australia do not currently impose an annual surcharge on foreign owners in the form of a land tax. However, each of these states may impose a surcharge in the form of additional transfer duty on the acquisition of a property by a foreign purchaser.

LAND TAX SURCHARGE NEW SOUTH WALES

If you are a foreign person who owns residential land in NSW, you must pay a land tax surcharge (“LTS”) of 2.00% from the 2018 land tax year onwards.

This is in addition to the 1.6% land tax amount. The LTS is only payable by foreign persons owning land in NSW.

It applies to all properties owned by foreign persons including their principal place of residence. Importantly there is no tax free threshold applicable to the LTS.

Foreign persons will not be provided with a tax-free threshold for the land tax surcharge nor an exemption for the principal place of residence.

Australian citizens are not foreign persons, no matter where they reside.

Are you or your entities a ‘Foreign person’?

‘Foreign person’ is defined by reference to the definition under the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA), modified as follows:

an individual not ordinarily resident in Australia (except for Australian citizens or a New Zealand citizen holding a special category visa under section 32 of the Migration Act 1958); or

a corporation or trustee of a trust in which an individual not ordinarily resident in Australia, a foreign corporation or a foreign government holds a substantial interest (20%); or

a corporation or trustee of a trust in which two or more persons, each of whom is an individual not ordinarily resident in Australia, a foreign corporation or a foreign government, hold an aggregate substantial interest (40%); or

any other person, or any other person that meets the conditions, prescribed by the Foreign Acquisition and Takeovers Regulation (Regs). Specifically, clauses 18, 46 and 47 of the Regs.

The modified definition of ‘Foreign Person’ excludes an Australian citizen and New Zealand citizen holding a special category visa from liability to the surcharges no matter where they reside. A non-Australian citizen will be ‘ordinarily resident’ in Australia at a particular time where the individual has actually been in Australia during 200 or more days in the last 12 months and is not (or was not from most recent departure) subject to any legal limitation as to time for continued presence in Australia. A person who falls outside of the exclusion or is not ‘ordinarily’ in Australia will be regarded a ‘foreign person’.

The land tax surcharge will apply to taxable value of residential land owned by a foreign person at midnight on 31 December in any year commencing on 31 December 2016 including trusts with discretionary beneficiaries that may be ordinarily outside of Australia.

Review trusts that own residential land prior to 31 December to consider amendment to discretionary trust deed to exclude ‘foreign persons’ and limit the liability of trustee.

Foreign persons will not be eligible for the tax-free land tax threshold.

Foreign persons who own a principal place of residence in NSW will be subject to land tax of 0.75% from 2017 and two per cent from the 2018 land tax year onwards, on the taxable value of their land.

The land tax surcharge applies to foreign persons even if the property is exempt from general land tax except where the property is predominantly used for primary production.

Foreign persons must carefully consider the long-term holding costs for residential land in NSW taking into account the land tax surcharge.

Land tax surcharge will be imposed to the extent the foreign person’s interest in land is used for residential purpose.

https://www.revenue.nsw.gov.au/taxes-duties-levies-royalties/land-tax/surcharge-land-tax

LAND TAX SURCHARGE VICTORIA

Absentee owner surcharge

If you own property in Victoria, you may have to pay land tax.

From the 2020 land tax year, an absentee owner surcharge of 2% applies to Victorian land owned by an absentee owner. The surcharge was 1.5% from 1 January 2017 and 0.5% for the 2016 land tax year.

The absentee owner surcharge is an additional amount that applies over the land tax you pay at general and trust surcharge rates.

Absentee owners need to advise the State Revenue Office of their status or penalties may apply.

What is an absentee owner?

An absentee owner is an absentee person that owns land in Victoria, and can be:

- an absentee individual,

- an absentee corporation, or

- a trustee of an absentee trust.

Each of these terms has a specific meaning. You should refer to each term for more information to see if the absentee owner surcharge applies to you.

When will the surcharge apply?

If you are an absentee owner at 31 December, the surcharge applies in the following land tax year.

The surcharge is calculated on the total taxable value of Victorian land you own and will be included on your Victorian land tax assessment. The surcharge calculation depends on who owns the land and how they own it, for example if the land is jointly owned, owned by an absentee corporation that is part of a land tax group or owned by a trustee of an absentee trust that is a discretionary trust, unit trust or fixed trust.

The surcharge does not apply if land is exempt from land tax or if the total taxable value of your land(s) is below the threshold of $250,000 or $25,000 (if the land is held on trust and is subject to the trust surcharge rate).

If your land attracts special land tax, you’ll pay this one-off tax at an absentee owner rate of 7% from the 2020 land tax year.

https://www.sro.vic.gov.au/absentee-owner-surcharge

LAND TAX SURCHARGE QUEENSLAND

If you are a foreign individual and do not ordinarily reside in Australia, you may be an absentee for land tax purposes.

From 30 June 2019, Australian citizens and permanent visa holders are not deemed absentees.

New Zealand citizens are absentees unless they ordinarily reside in Australia.

As an absentee, you are liable for land tax if the total taxable value of your freehold land at 30 June is $350,000 or more.

The land tax rates for absentees and a surcharge will apply to the land you own.

Similar to other types of owner, you will be assessed only on the land you own, which includes the value of your share in any land owned with others.

Read about annual land valuations if you want to learn about how your land is valued and what information is included in your notice.

Determining absentee status

The State Revenue Office considers several factors to determine if you usually live in Australia, such as the reason for your absence and the time spent in and out of the country. As a foreign individual, you will be an absentee if you:

- were away from Australia at 30 June or

- have been away from Australia for more than 6 months in total during the financial year before 30 June.

If you are an absentee, you cannot claim a home or primary production exemption.

If the total taxable value of your land exceeds $350,000, you must tell the State Revenue Office within 1 month of the date you move overseas by completing an absentee/resident status declaration (Form LT16).

Working overseas

In limited cases, the land tax rates for individuals will continue to apply for foreign individuals working overseas. For this to apply, you must:

- be a public officer of the Commonwealth or of a state, who is absent in the performance of your duties or

- have been working for your employer in Australia for at least 1 continuous year before you go overseas, and are directed by that employer to continue working for them overseas for a period less than 5 years. If the period is longer, you will be reassessed as an absentee for the whole time you are overseas.

If you believe these arrangements apply to you, complete an absentee/resident status declaration (Form LT16) and include copies of your Australian and overseas employment contracts.

Similarly, if you have received the benefit of the above arrangements, complete a Form LT16 and send it to the State Revenue Office within 28 days of:

- ceasing to work for your employer

- working overseas for more than 5 years (public officers excluded).

Interest and penalties may apply if you don’t tell us that your resident status has changed.

https://www.qld.gov.au/environment/land/tax/calculation/absentees

Foreign companies and trusts for land tax

As a foreign company or trustee of a foreign trust, you are liable for land tax if the total taxable value of your freehold land at 30 June is $350,000 or more.

Foreign company

Your company is foreign if:

- it is incorporated outside Australia

- foreign persons or related persons of foreign persons have at least 50% controlling interest.

Trustee of a foreign trust

You are a trustee of a foreign trust if at least 50% of the trust interests are held by:

- an individual who is not an Australian citizen or permanent resident

- a foreign company

- a trustee of a foreign trust

- a related person of any of the above.

- Your interest in a trust as a beneficiary is the percentage of the value of your entitlement under the trust. There are special rules for discretionary trusts where only ‘takers in default’ (i.e. people whose entitlements as beneficiaries result from the trustee not exercising their discretion) of an appointment by the trustee have a trust interest.

Read the public ruling on foreign corporations and trusts (LTA000.3) for more information.

Surcharge

A surcharge of 2% applies in addition to the land tax rates for companies and trustees. The surcharge will appear on the land tax summary section of your assessment notice.

https://www.qld.gov.au/environment/land/tax/calculation/foreign-companies

As part of the coronavirus relief package, the surcharge was waived for the 2019–20 assessment year.

LAND TAX SURCHARGE AUSTRALIAN CAPITAL TERRITORY

If you’re a foreign person who owns residential land in the ACT, you must pay a land tax surcharge of 0.75 per cent of the Average Unimproved Value per year from 1 July 2018 onwards.

The surcharge is in addition to land tax you must pay if a property isn’t your principal place of residence.

If you’re a foreign person and you already pay land tax, you’ll need to notify the State Revenue Office about your foreign status which you can do using the Land Tax Notification Form and pay the surcharge. Penalties may apply if you don’t notify the State Revenue Office about your foreign status. They will calculate the surcharge as part of your land tax assessment.

https://www.revenue.act.gov.au/land-tax/foreign-ownership-surcharge